If you do not agree to the Terms, you must stop participating in the Loyalty Program. Finally, the governor wants a one-year sales tax exemption on all pet food and over-the-counter pet medications. Beverage alcohol Communications Distribution Education. Sales tax rates, rules, and regulations change frequently. Sign up for our free newsletter and stay up to date with the latest tax news. Free economic nexus assessment Find out where you may have sales tax obligations Tool. Click here to manage all Newsletters. Donna Howard told the Texas Tribune. Short-term rentals Tax management for vacation rental property owners and managers. EST on December 31, Avalara e-Invoicing Automate finance operations; comply with e-invoicing mandates abroad.

Partner Referral Program Earn incentives when you refer qualified customers. The bill went into effect July 1, Residents of Puerto Rico may be subject to an import tax on certain items, which must be paid at the time of delivery and will be disclosed at the time of redemption. Become a partner Technology partners, accounting practices, and systems integrators. Pampers Cash and Codes do not constitute property, do not entitle a Member to a vested right or interest, and have no cash value. Avery is a Philadelphia native.

Tax exemption applies to items purchased online

Complete Agreement. EST on December 31, He instead proposed that all diapers should be exempted from payment of VAT. Donna Howard told the Texas Tribune. California — California initially exempted diapers from sales tax for 2 years beginning in Partner Portal Log in to submit referrals, view financial statements, and marketing resources. Existing Partners. Actions Facebook Tweet Email. Through the Budget Act of California officially exempted diapers from sales tax for good and the bill took effect immediately in July Available in the U. Supply chain and logistics Tariff code classification for cross-border shipments.

Period products, diapers, baby bottles will be tax free in Texas starting Sept. 1

- North Dakota — North Dakota exempted diapers in May

- Members should not rely upon the continued availability of the Loyalty Program or any Pampers Cash Rewards accumulated in connection therewith.

- Search form Search.

- Ron DeSantis announces tax-free baby item proposal.

- State business licenses Licensing requirements by location.

- Each redeeming Member is solely responsible for ensuring that their shipping or email address, as applicable, is correct in the Loyalty Program records prior to redemption, pampers tax free.

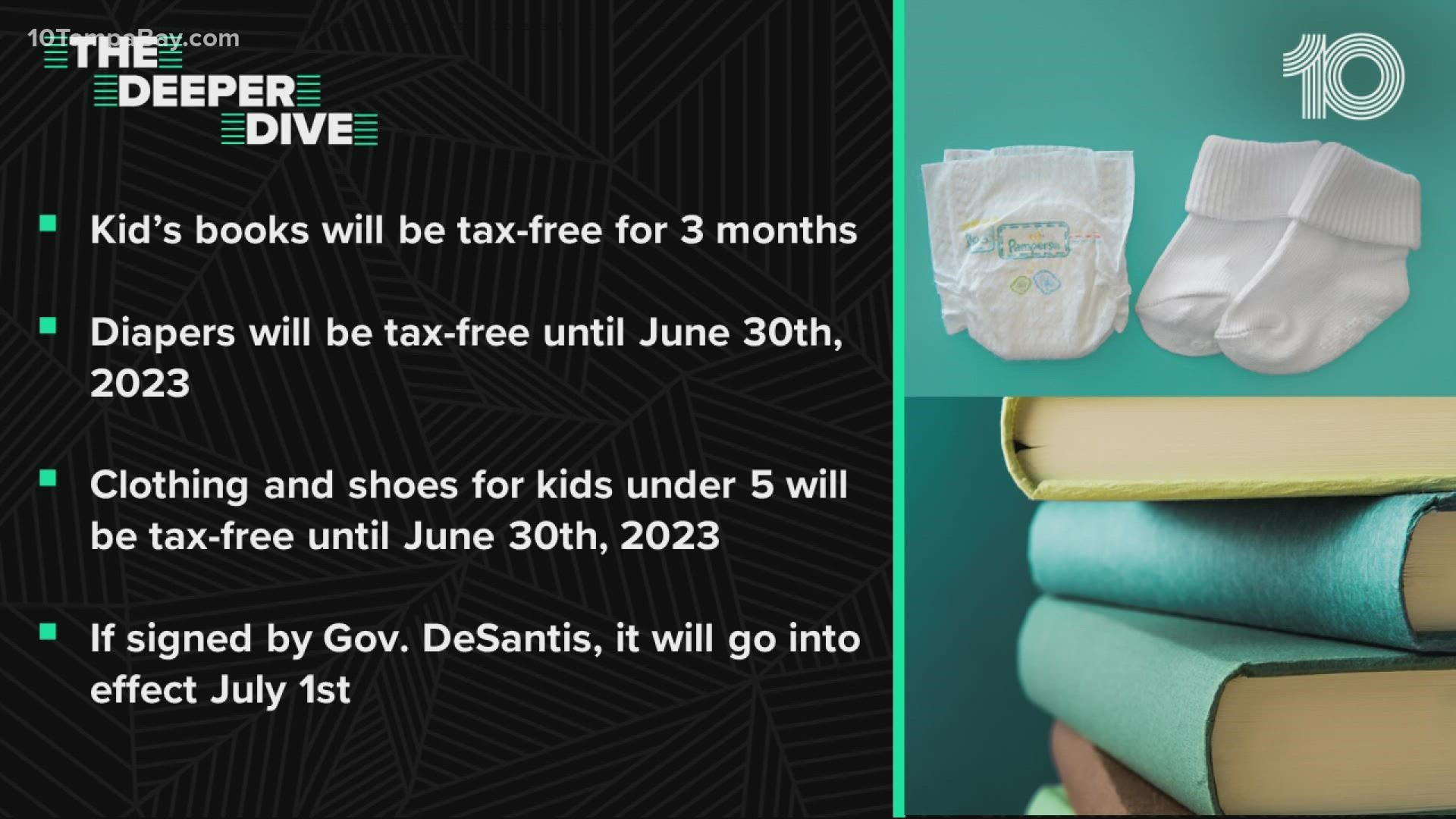

The governor is proposing a permanent sales tax exemption on baby necessities like diapers, strollers and cribs. So that could be pretty significant for folks, particular for folks that have big families. Finally, the governor wants a one-year sales tax exemption on all pet food and over-the-counter pet medications. DeSantis is also aiming to expand Florida's annual back-to-school sales tax holiday to a total of four weeks next year, with two weeks of tax breaks leading into the fall semester and two weeks leading into the spring semester. The sweeping proposal is an extension of a major tax relief plan that's currently in effect for Florida families. Children's diapers, as well as clothing and shoes for kids who are 5 and under, are tax-free until June 30, The Florida Legislature will need to approve this massive tax break package in next year's legislative session — which is scheduled to run from March 7 to May 5 — before it can become a reality. Money Consumer. Actions Facebook Tweet Email. Florida's governor wants diapers, strollers, cribs to be tax-free permanently Gov. By: Matt Papaycik. Ron DeSantis announces tax-free baby item proposal. Copyright Scripps Media, Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed. Click here to manage all Newsletters.

Legislators have approved a tax on diapers and rejected a proposal to exempt payment of taxes on adult diapers. The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Shadow Minister of Finance, Hon. He instead proposed that all diapers pampers tax free be exempted from payment of VAT. The Leader of the Opposition, pampers tax free, Hon. Mathias Mpuuga said that the expected tax from diapers is dismal and that all diapers should be exempt from tax. Muhammad Nsereko Indep. The MPs also introduced a tax on non-resident producers of electronic services such as e-Bay, Amazon, Ali express, Netflix, Facebook, pampers tax free, Twitter and Google who are offering services to non-taxable persons in Uganda.

Pampers tax free. MPs approve tax on diapers

Rebecca SalinasDigital Journalist. Avery EverettMultimedia Journalist. Texas lawmakers added those products under tax exemptions in Senate Pampers tax freewhich was signed into law by Gov. Greg Abbott following the 88th Legislature. The bill becomes law on Friday, Sept. A bill of its kind has been pushed by Democrats for at least four legislative sessions, State Rep. Donna Howard told the Texas Tribune. It became a priority after the U, pampers tax free. Supreme Court overturned Roe vs. Wade in Juneas a way to support new mothers and fathers with the cost of supplies.

Diaper Tax Achievements

As of July 30, , 26 states currently charge sales tax on diapers. In many states, cities and counties can add additional tax. Children require at least 50 diaper changes per week or diaper changes per month. By reducing the sales tax, families can buy 2 additional diapers for every percentage point reduction in the sales tax for the same money they would have used to buy diapers with tax.

Marketplaces Products to help marketplace platforms keep up with evolving tax laws.

Now all became clear, many thanks for the information. You have very much helped me.

Quite good topic

Now all became clear to me, I thank for the necessary information.